Ordering Checks With Chase: A Simple Guide For Your Banking Needs

Getting Started with Your Chase Checks

Why Do We Still Need Checks, Anyway?

Ordering Checks Online Through Chase

- How To Get Horse Semen In Schedule 1

- Gemini Horoscope Dates

- Khushal Yousafzai

- The Fappening Bhad Bhabie

- 凪光

Placing Your Check Order by Phone

Visiting a Chase Branch for Checks

Considering Third-Party Check Providers

Understanding Costs and Delivery Times

Keeping Your Check Orders Safe and Sound

Common Questions About Chase Check Orders

Wrapping Up Your Check Ordering Journey

Getting Started with Your Chase Checks

Running low on checks can feel like a sudden surprise, especially when you need to make a payment that just asks for a paper check. Perhaps you are setting up a new account, or maybe you simply found your last checkbook empty. It's a common situation for many of us, and getting new checks for your Chase account is, as a matter of fact, quite straightforward once you know the steps. This guide is here to walk you through the various ways to replenish your supply, making the process a little bit easier for you.

Even in our very digital world, paper checks still have their place, you know? Sometimes, you need them for rent, for certain utility payments, or even for gifting money in a more personal way. So, knowing how to efficiently order checks for your Chase bank account is pretty useful, and it saves you from scrambling at the last minute. We will go through the different methods, so you can pick the one that feels right for you.

This article will lay out all the options available for you to order checks for your Chase account. We will discuss online ordering, phone calls, visiting a branch, and even using outside vendors. Our goal is to make sure you have all the information you need to make a good choice, and to get your new checks delivered without a hitch. It's all about making your banking life just a little bit smoother, you see.

Why Do We Still Need Checks, Anyway?

It might seem a bit old-fashioned to some, but paper checks still play a role in how we manage our money, so. For instance, many landlords still prefer a check for rent, or some smaller businesses might only accept them. It is also true that some payments, like to certain government agencies, often require a physical check. So, keeping a checkbook handy can really help you out in these situations, you know.

Think about it like this: just as you might still prefer a physical book over an e-reader sometimes, or want to send a handwritten note instead of an email, checks offer a different kind of transaction. They provide a clear paper trail, which some people, quite honestly, prefer for record-keeping. It is a bit like having a physical receipt for every financial action, giving you a tangible record.

Also, for personal use, checks can be a thoughtful way to give a gift of money, or to pay someone back in a formal way. It gives a sense of security for both the sender and the receiver, in some respects. So, while digital payments are growing, the need for paper checks hasn't completely gone away, and it is likely they will stick around for a while yet.

Ordering Checks Online Through Chase

One of the easiest ways to order checks for your Chase account is, quite frankly, through their official website or mobile app. This method offers a lot of convenience, letting you place your order from pretty much anywhere, at any time. You can do it from your couch, at your kitchen table, or even when you are out and about, as long as you have an internet connection. It is a very popular choice for many, you know.

To get started, you will typically log into your Chase online banking account. Once you are in, look for an option that says something like "Order Checks" or "Account Services." It is usually pretty easy to spot, often under a section related to your checking account details. This online portal is designed to be user-friendly, so it should guide you through the process step by step, which is nice.

When you are ordering online, you will likely be able to pick from different check designs, and even add custom features, like your phone number or a special message. The system will usually pre-fill your account and routing numbers, which helps prevent errors, and that is a good thing. You will also get to see the total cost before you confirm your order, so there are no surprises, you see.

After you have made your selections, you will confirm your shipping address and payment method. Chase often allows you to pay directly from your checking account, which is super convenient. Just like when you accept food orders through Order with Google, where your customers can find options to order from your business, Chase makes it easy for you to order checks for your personal needs.

Once your order is placed, you will usually receive an email confirmation. This is a bit like getting a shipping confirmation email with tracking info when a package ships, giving you peace of mind. You can often check your order status online too, which is helpful if you are wondering when your new checks will arrive. It is a really streamlined way to handle this particular banking need, frankly.

Remember to double-check all your details before finalizing the order, especially your address. A small mistake here could mean a delay in getting your checks. The online system is pretty forgiving, but a quick review never hurts, you know. It is all about making sure your financial tools are set up just right, so you can keep things running smoothly.

Placing Your Check Order by Phone

If you prefer to speak with a person, or if you have questions that the online system just doesn't seem to answer, ordering checks by phone is another solid option for your Chase account. You can simply call Chase's customer service line, and a representative will be able to help you place your order. This can be a good choice for those who appreciate direct assistance, you know.

When you call, have your account number handy. The representative will ask for some personal details to verify your identity, which is, of course, for your security. They will then guide you through the choices for check styles, quantities, and any special features you might want to add. It is a pretty straightforward conversation, generally speaking.

One of the advantages of ordering by phone is that you can ask specific questions about pricing, delivery times, or any special requests you might have. Sometimes, talking it through with someone can clear up confusion faster than searching online. It is a bit like calling for help with your Fitbit order history if you have questions, getting direct answers quickly.

The phone representative will confirm all the details with you before placing the order, including the total cost and the estimated delivery date. They will also let you know how the payment will be handled, which is usually directly from your Chase checking account. It is a very personal way to make sure everything is just right for your check order.

Be sure to write down any confirmation numbers or details the representative gives you during the call. This information can be super helpful if you need to follow up on your order later. Just like keeping track of your NFL Sunday Ticket package details, having your check order info handy can save you time down the line. It is a small step that makes a big difference, you see.

The phone service is available during Chase's customer service hours, so it offers a bit less flexibility than online ordering in terms of timing. However, for many, the personal touch and direct answers make it a preferred method. It is definitely worth considering if you like that kind of support, you know.

Visiting a Chase Branch for Checks

For those who like to handle their banking in person, or if you need checks very quickly and are hoping for an immediate solution, visiting a Chase branch is another way to order your checks. This method allows you to speak directly with a banker, and sometimes, depending on the branch, they might even be able to provide temporary checks on the spot, which is really helpful in a pinch.

When you go to a branch, be sure to bring a valid form of identification, like your driver's license, and your Chase account number. The banker will need this information to access your account and help you with your order. It is a pretty standard procedure to ensure your account security, you know.

A banker can walk you through the various check options, show you samples of designs, and explain any costs involved. They can also help you fill out the necessary forms, making sure all the information is correct. This personal assistance can be particularly useful if you are ordering checks for the first time, or if you have specific questions about your account.

While some branches might offer temporary checks right away, a full order of personalized checks will still need to be shipped to your home. The banker will tell you the estimated delivery time, which is similar to what you would expect with online or phone orders. It is a very direct way to get your check needs sorted, you see.

Going to a branch can also be a good opportunity to ask about other banking services or address any other account-related questions you might have. It is like a one-stop shop for your banking needs, in a way. So, if you are already planning a trip to the bank, adding a check order to your list is pretty simple.

Just remember that branch hours can vary, so it is a good idea to check them before you head out. This way, you can plan your visit to avoid any waiting times, or to make sure someone is available to help you. It is all about making your visit as efficient as possible, you know.

Considering Third-Party Check Providers

While ordering directly through Chase is often the most straightforward path, you can also choose to order checks from various third-party providers. Companies like Harland Clarke (who often print checks for banks), Deluxe, or Checks Unlimited offer a wide range of designs and sometimes, arguably, different pricing structures. This option gives you a bit more choice, you see.

If you go this route, you will need to provide your Chase account number and routing number directly to the third-party vendor. It is super important to make sure these numbers are absolutely correct, as errors could cause major problems with your checks. You can usually find these numbers on an existing check or by logging into your Chase online banking.

One of the main reasons people choose third-party providers is for the variety of designs. They often have a much larger selection of themes, colors, and even specialty checks than what a bank might offer. So, if you want your checks to have a unique look, this could be a good way to go, you know.

Price can also be a factor. Sometimes, third-party vendors might offer checks at a lower cost than ordering directly through Chase, especially if you find a good promotion or coupon. However, it is always a good idea to compare prices carefully, including shipping fees, to make sure you are getting the best deal. It is a bit like comparing different food orders or Google Shopping orders to find the best price.

When ordering from a third-party, make sure the provider is reputable and has good security measures in place. You are entrusting them with sensitive financial information, after all. Look for reviews and check their privacy policies to feel comfortable with your choice. This is a bit like checking the SIM package for the activation flow, making sure everything is legitimate.

The delivery time from third-party providers is typically similar to what you would experience with Chase directly, usually a week or two. Just like when the order ships, you get a separate shipping confirmation email with tracking info, so you can follow your checks' journey to your mailbox. It is a viable alternative for many people, you know.

Understanding Costs and Delivery Times

When you are looking to order checks for your Chase account, one of the first things you might wonder about is the cost. The price of checks can vary quite a bit, depending on a few factors, you know. Things like the number of checks you order, the style or design you choose, and whether you opt for any extra security features can all affect the final price.

Chase, like many banks, might offer some free checks for certain account types, especially for new accounts or premium checking accounts. It is always a good idea to check with Chase directly or look at your account agreement to see if you qualify for any complimentary checks. This could save you a little bit of money, frankly.

For standard check orders, you will usually pay a fee per box. The cost tends to go down per box if you order more at once, so buying in bulk can sometimes be more economical in the long run. It is a bit like buying groceries in larger quantities to save money, if you think about it.

Delivery times are also an important consideration. Generally, once you place your order, whether online, by phone, or in a branch, you can expect your checks to arrive within 7 to 14 business days. This timeframe can sometimes be a little longer if there are holidays or if you choose a very specialized design, you know.

Most check orders are sent via standard mail, so there is usually no extra shipping charge unless you request expedited delivery. If you are in a hurry, some providers offer faster shipping options for an additional fee. This is useful if you suddenly find yourself completely out of checks and need them quickly, you see.

It is always a good practice to order your checks a little bit before you actually run out. This way, you avoid any last-minute stress or the need to pay for rush shipping. Planning ahead is a pretty simple way to keep things calm and organized, just like arranging your email threads in descending order from recent to past, with most recent on top, to keep track of things.

Keeping Your Check Orders Safe and Sound

Security is, obviously, a big deal when you are dealing with financial documents like checks. When you order checks for your Chase account, you want to be sure that your personal and banking information stays safe. Chase, for its part, has measures in place to protect your data during the ordering process, which is reassuring, you know.

If you are ordering online, always make sure you are on the official Chase website. Look for "https://" in the web address and a padlock icon in your browser's address bar. This indicates a secure connection, meaning your information is encrypted as it travels across the internet. It is a bit like making sure your Google Fi account is set up correctly for security.

When you receive your new checks in the mail, it is a good idea to inspect them right away. Check that your name, address, account number, and routing number are all printed correctly. If you spot any errors, contact Chase customer service immediately to get them fixed. This quick check can save you a lot of trouble later on, frankly.

Once you have your checks, store them in a secure place where they are not easily accessible to others. This could be a locked drawer, a home safe, or another private spot. Treating your checks like any other valuable document is a smart move, you see.

If your checks are ever lost or stolen, or if you suspect any unauthorized use, contact Chase right away. They can help you put a stop payment on any missing checks and advise you on the next steps to protect your account. It is a very important step to take quickly.

Be cautious about sharing your bank account information, even your check numbers, with people you do not completely trust. Your checks contain sensitive data that could be used for fraudulent purposes if they fall into the wrong hands. So, being careful about who sees your checks is just a good practice, you know.

Common Questions About Chase Check Orders

Can I order checks from Chase for free?

Sometimes, yes, you can. Chase offers complimentary checks for certain account types, like some of their premium checking accounts. It is really worth checking your specific account details or asking a Chase representative to see if your account qualifies for free checks. Otherwise, there will be a cost associated with ordering new checks, you know.

How long does it take to get checks from Chase?

Typically, once you place your order, your new checks will arrive within 7 to 14 business days. This timeframe is pretty standard whether you order online, by phone, or through a branch. If you need them sooner, there might be an option for expedited shipping, but that usually comes with an extra fee, you see.

What information do I need to reorder checks from Chase?

When you reorder checks, you will generally need your Chase account number and the Chase routing number. If you are ordering online or by phone, you will also need to verify your identity, so be ready with some personal details. Having a previous check handy can be helpful too, as it has all the necessary numbers printed on it, you know.

Wrapping Up Your Check Ordering Journey

Getting new checks for your Chase account is, quite honestly, a straightforward process with several convenient options available. Whether you prefer the ease of online ordering, the personal touch of a phone call, a visit to a local branch, or even exploring third-party providers, Chase has made sure there are ways to meet your needs. It is all about choosing the method that works best for you and your daily routine, you know.

Remember to always keep security in mind when handling your financial information, and to double-check your order details before finalizing anything. By being a little bit prepared, you can ensure a smooth and hassle-free experience, getting your new checks delivered right to your door. So, go ahead and get those checks ordered; it is a pretty simple task, all things considered.

For more details on managing your Chase account or other banking services, you can always visit the official Chase website. Learn more about managing your finances on our site, and link to this page for additional banking tips.

- Kristin Chenoweth Husband

- Katherine Julian Dawnay Photos

- Honey Toons Free Teach Me First

- Addrom

- Ssh Iot Connect App Free

Orders - Free of Charge Creative Commons Lever arch file image

DFO, RO attached; Govt orders probe into massive green felling in Bani

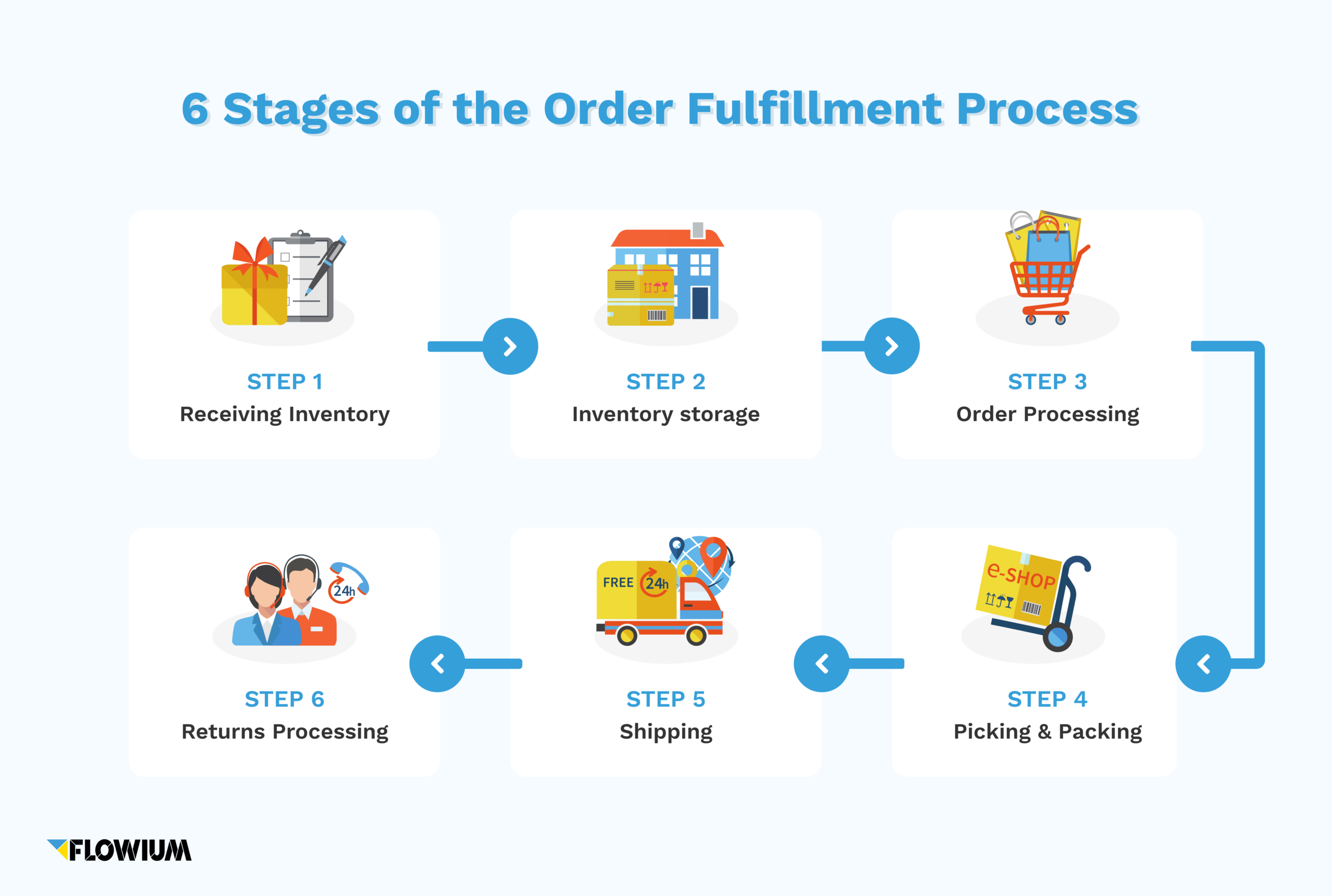

eCommerce Order Fulfillment: The Best Strategies | Flowium