Getting Fast Cash: A Look At Lendli Loans For Your Needs

Are you looking for a quick way to get some extra money? It's a common situation, isn't it? Sometimes, life just throws unexpected expenses our way, or maybe you simply need a little boost to manage things until your next paycheck. That's where options like lendli loans often come into the picture, promising a speedy solution when you're in a pinch.

Many folks find themselves wondering about online loan services. It's really quite important to know what you're getting into, especially when you need cash fast. You want something that is trustworthy, something that works simply, and something that won't give you any big surprises down the road, you know?

This article will help you understand a bit more about lendli loans. We'll explore what they offer, how they work, and what you might want to think about before deciding if one is right for you. We'll also touch on common questions people have, like whether lendli.com is legitimate, and how you can get started, so it's almost a complete picture.

- How Long Has Swamp People Been On Tv

- Yua Mikami

- Triplexceleste Of

- Kurt Buschs Net Worth

- Was Christopher Walken A Dancer

Table of Contents

- What Are Lendli Loans?

- Is Lendli.com Legit or a Scam?

- How Do Lendli Loans Work?

- Pros and Cons of a Lendli Loan

- Qualifying for a Lendli Loan

- Lendli Loan Types by State

- Frequently Asked Questions About Lendli Loans

- Making Your Decision About Lendli Loans

What Are Lendli Loans?

Lendli loans are, in a way, designed to help people get cash pretty fast. They are a kind of online installment loan, which means you borrow a set amount of money and then pay it back over time with regular, scheduled payments. This can be a very helpful option when you're facing an unexpected bill or just need some financial breathing room until your next payday, you know?

Quick Cash When You Need It

The main idea behind lendli loans is to provide money quickly. When you need cash in a hurry, waiting around for days or even weeks for a traditional loan just isn't an option. Lendli tries to make the process speedy, allowing you to apply online and, in some cases, get your funds in as little as 24 hours. That's a pretty quick turnaround, isn't it?

Many people appreciate this speed. It means that if you have an urgent expense, like a car repair or a medical bill, you might be able to get the money you need without too much delay. The whole process is set up to be quick and fair, which is something a lot of folks are looking for in a loan service, in a way.

Loan Amounts and Speed

With lendli, you can apply for different amounts of money. The loans generally range from $1,000 to $2,000. So, whether you need a grand, a thousand five hundred, or two thousand dollars, they offer those specific amounts. This flexibility can be quite helpful, as you can choose the amount that fits your particular need without borrowing too much or too little, if that makes sense.

The approval process for these loans is also set up to be swift. You apply online, and if everything goes well, you could receive your money in as fast as 24 hours. This means that from the moment you decide you need a loan to the time the money is in your account, it could be less than a day. That's a very fast turnaround for a financial product, you know?

Is Lendli.com Legit or a Scam?

A very common question people have about any online service, especially one dealing with money, is whether it's legitimate or a scam. It's smart to be cautious, isn't it? The information available suggests that lendli.com is a real company offering loans, not a fraudulent operation. People often want to read reviews and check company details to make sure a site is trustworthy, and that's a good approach.

Checking Trustworthiness

When you're trying to figure out if a site like lendli.com is trustworthy, it's a good idea to look for reviews and company details. You might want to see what other people have said about their experiences. Reading these kinds of reviews can help you get a sense of how the company operates and if it meets the expectations of its customers. This kind of research is very helpful in making an informed choice, so it is.

You can also look into the company's background and any technical analysis available. This might involve checking their website's security features or looking for information about their business practices. Knowing these things helps you decide if a site is reliable or if there are any red flags. It’s about doing your homework before you commit, which is a good thing.

No Hidden Fees, No Hassle

One thing Lendli mentions is that they have no hidden fees or hassle. This is a very important point for anyone considering a loan. Nobody wants to be surprised by extra charges they didn't know about. A clear and upfront fee structure helps build trust and makes the borrowing experience less stressful, which is something we all appreciate, you know?

The idea of "no hassle" suggests that the application process and the overall interaction with Lendli are meant to be straightforward. This means less paperwork, fewer complicated steps, and a more user-friendly experience. When you're in a hurry for cash, a simple process is definitely a big plus, apparently.

How Do Lendli Loans Work?

Lendli loans are designed to be repaid in a specific way, which is something you should definitely know about. They are set up as installment loans, meaning you pay back a fixed amount over a period of time. This makes budgeting a bit easier, as you know exactly what your payments will be. It's a pretty common structure for personal loans, actually.

Repayment from Your Paycheck

A key feature of lendli loans is how they are repaid. The information suggests that these loans are repaid directly from your paycheck. This means that when you get paid, a portion of your earnings goes directly towards paying back your loan. This can make managing your payments simpler, as you don't have to remember to send in a payment manually each time, so it's a bit automated.

For some people, this repayment method can be very convenient. It helps ensure that payments are made on time, which is good for your financial standing. However, it also means you need to be sure that the repayment amount fits comfortably within your budget after your paycheck deduction. It’s a good idea to consider how this will affect your take-home pay, you know?

Understanding the Application Process

Applying for a lendli loan is meant to be a simple online process. You can apply directly through their website, which makes it accessible from pretty much anywhere. The goal is to make it friendly and speedy, so you can get through it without too much trouble. This ease of access is a big draw for many people looking for quick cash, apparently.

Once you apply, the approval process is also quite fast. As mentioned, some people can get approved and receive their funds in as little as 24 hours. This swift approval is a key part of what makes lendli an option for urgent financial needs. It’s really about getting you the money you need without a long wait, which is often the point of these kinds of loans.

Pros and Cons of a Lendli Loan

Like any financial product, lendli personal loans have their good points and things you might want to think about. It’s always smart to weigh these out before making any decision. Understanding both sides helps you figure out if it's the right fit for your situation, you know?

The Good Points

One of the biggest advantages of lendli loans is the speed. You can apply online and potentially get cash in your account in as little as 24 hours. This is incredibly helpful if you have an urgent expense that just can't wait. The quick approval process means less stress when time is of the essence, which is often the case when people seek these loans.

Another positive is the transparency regarding fees. Lendli states there are no hidden fees, which can give borrowers peace of mind. Knowing exactly what you're paying upfront helps you budget and avoids unpleasant surprises later on. This clear approach is something a lot of people appreciate in a loan service, you know?

The fact that loans are repaid from your paycheck can also be seen as a pro for some. It automates the repayment process, helping to ensure you don't miss payments. This can be very convenient and help you stay on track with your financial commitments, so it's a useful feature for many.

Things to Consider

While the repayment from your paycheck can be convenient, it also means you need to be sure your budget can handle the deduction. It’s important to look at your income and expenses to make sure that the loan payment won't cause new financial strain. You really want to avoid getting into a situation where one solution creates another problem, you know?

Also, like all loans, there are charges involved. It's important to understand how much the loan will cost you overall. While there are no hidden fees, you still need to know the interest rates and any other charges that apply. Comparing these costs with other options is always a smart move to make sure you're getting a fair deal, so it is.

Qualifying for a Lendli Loan

If you're thinking about applying for a lendli loan, you'll need to know what it takes to qualify. Every lender has certain requirements, and Lendli is no different. Knowing these details beforehand can save you time and help you prepare your application, which is always a good thing, you know?

What You Need to Know

The specific criteria for qualifying for a lendli loan will be detailed by the lender themselves. Typically, with online installment loans, lenders look at things like your income, employment status, and sometimes your credit history, though some lenders might be more flexible than traditional banks. It's about showing that you have the ability to pay back the loan, basically.

You'll likely need to provide some personal information and details about your finances during the application process. This helps Lendli assess your eligibility. Being prepared with this information can make the application go smoothly and quickly, which is what you want when you're looking for fast cash, isn't it?

Lendli Loan Types by State

Loan products can vary quite a bit depending on where you live. Financial regulations are different from state to state, so what's available in one place might not be in another. This is something important to keep in mind when you're looking into lendli loans, or really any loan for that matter, you know?

Checking Availability

Lendli provides a list of its loan types by state. This means you can check if their services are available where you live and what specific loan products they offer in your area. It's a good idea to look this up before you apply, just to make sure you're not wasting your time. You want to be sure they can actually help you, right?

Accessing this information is pretty simple. You'd typically find it on their website, perhaps in a "states served" or "availability" section. Knowing the options for your state is a key step in deciding if a lendli loan is a viable option for you, so it's worth checking out early on.

Frequently Asked Questions About Lendli Loans

People often have similar questions when considering online loans. Here are a few common ones that might come up when you're thinking about lendli loans:

How quickly can I get money from Lendli?

You can apply online, and if approved, you might receive funds in as fast as 24 hours. This is pretty quick, especially for an online installment loan, you know?

Are there any hidden fees with Lendli loans?

According to the information, Lendli states they have no hidden fees or hassle. This means what you see is what you get in terms of costs, which is rather good for planning.

How do I repay a Lendli loan?

Lendli loans are set up to be repaid from your paycheck. This means payments are automatically taken out of your earnings, which can make managing the loan very convenient, so it is.

Making Your Decision About Lendli Loans

Deciding whether a lendli loan is right for you means looking at your own financial situation and what you need. They offer a quick way to get cash, with loans ranging from $1,000 to $2,000, and a speedy approval process that can get you funds in as little as 24 hours. The idea of no hidden fees and repayment from your paycheck can be quite appealing for many people seeking a straightforward borrowing experience, you know?

It’s important to consider all the details, including how much the loan charges and what it takes to qualify. Take some time to read reviews and understand the company's specifics. You can learn more about online installment loans on our site, and perhaps link to this page for more financial insights before making any big decisions.

Ultimately, a lendli loan could be a helpful option if you need cash fast and understand the terms. It's about finding a solution that fits your specific needs without adding unnecessary stress. Think about your budget, the repayment structure, and whether this type of loan aligns with your financial goals for today and tomorrow. For more general information about consumer finance, you might find resources from the Consumer Financial Protection Bureau helpful, too it's almost a complete picture.

Lendli

Types Of Loans, Eligibility, Benefits Explained - Fintoo Blog

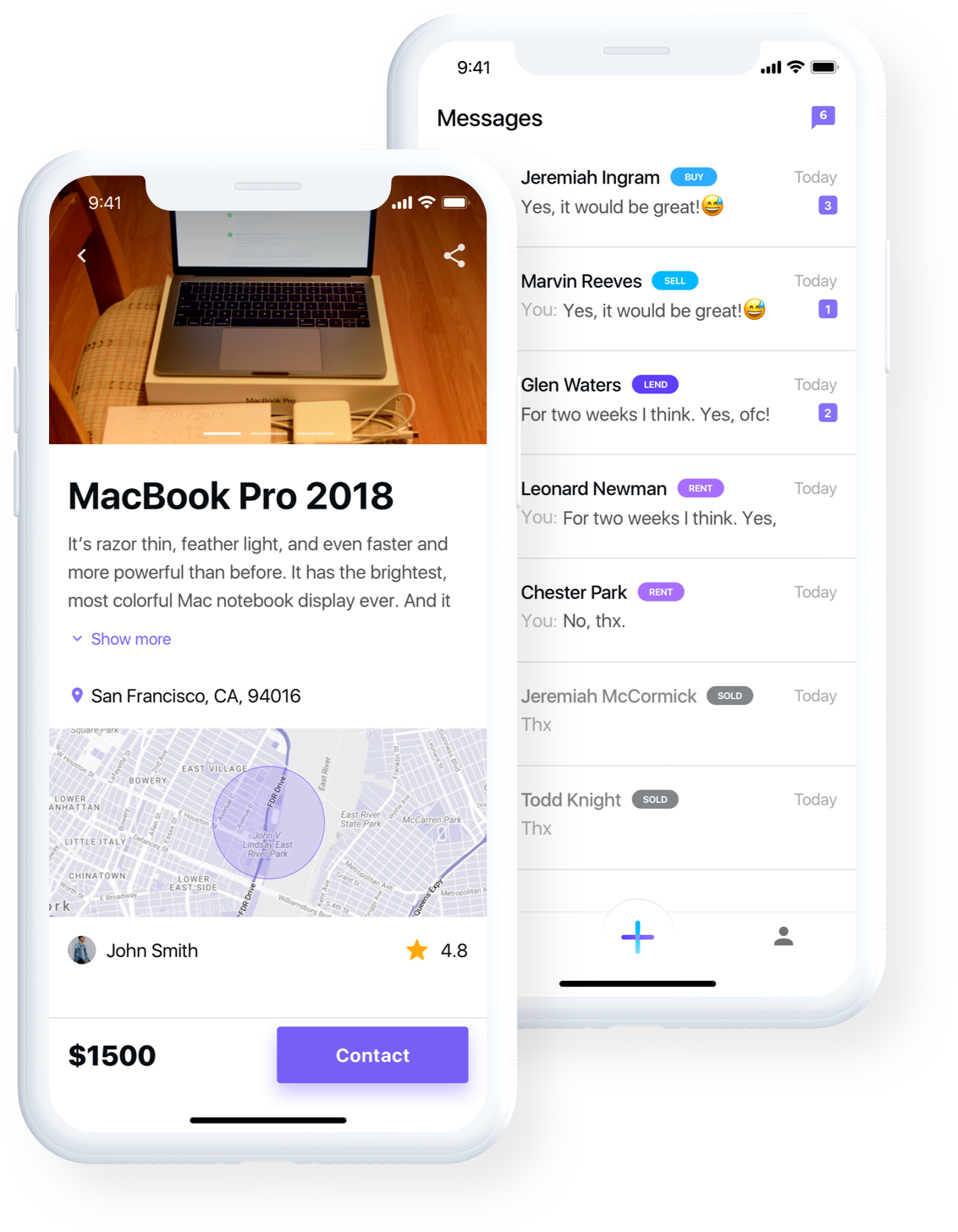

Lendli - Full Project on Behance